Seeking financing for a home or other real estate? Picking the right loan product that aligns with your aspirations and ensuring you snag the best rate for your situation can sometimes feel like a never-ending puzzle. Our mission? To streamline the home loan procedure for you. We're armed with the tools and expertise to steer you effortlessly from the get-go, beginning with a complimentary pre-approval letter request. We illuminate the distinctions between loan schemes, empowering you to make an informed choice, whether you're stepping into homeownership for the first time or you're an experienced investor.

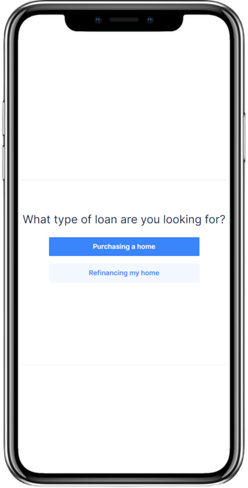

Here’s a snapshot of how our procedure unfolds:

Contemplating refinancing options for your home or other properties? Navigating the world of refinancing, ensuring you select a product aligned with your objectives, and securing the optimal rate for your situation can sometimes feel like a complex game. But worry not! Our goal is to simplify the refinancing journey. Equipped with the necessary tools and expertise, we guide you every step of the way, beginning with a complimentary refinance analysis. Our assistance provides clarity on the diverse loan options, facilitating an informed decision, be it for newcomers to homeownership or for seasoned property aficionados

Here’s a breakdown of how our approach functions:

A reverse mortgage is essentially a loan tailored for folks who are 62 years or older. These types of loans, known as HECM reverse mortgages, are backed by the Federal Housing Administration (FHA). They let homeowners transform their home equity into usable cash without the burden of monthly payments. We aim to make your reverse mortgage journey straightforward. With our tools and seasoned expertise, we'll guide you from start to finish, kicking off with our no-cost Reverse Mortgage Assessment. We'll shed light on the various reverse mortgage choices, empowering you to pick the one that resonates with your needs.

Here’s a snapshot of our process:

Manufactured homes, often referred to as "mobile homes," offer excellent housing solutions. Contrary to what the name suggests, these homes aren't on the go. You'd ideally set up a mobile home in a designated manufactured home community or on a piece of land you own. To qualify, the manufactured home should be permanently attached to the land you own, shouldn't have been relocated after its first setup, and it's crucial it was constructed post-1976. Opting for a manufactured home can bring some benefits:

- Buying one might cost less than getting a regular brick-and-mortar house.

- You might need a smaller chunk of money upfront compared to a standard loan.

Here’s a peek at the process:

A VA loan is a type of home loan in the U.S. that's got the backing of the U.S. Department of Veterans Affairs (VA). It's given out by special approved lenders. This loan is especially for American veterans or their partners who haven't remarried. We've got the tools and know-how to make getting a VA home loan super easy. And it all starts with our no-strings-attached VA Loan Check. We'll lay out the different loan choices for you, making it simple to pick the best fit, whether it's your first home or you've done this a few times.

Here’s the play-by-play:

If you're an enterprising individual living in the U.S. with an ITIN number, you're in luck. Our ITIN Mortgage Program is designed to bring homeownership within reach, especially for immigrant hopefuls in areas rich in cultural diversity that have traditionally been underserved. **What's an ITIN Number, Anyway?** An ITIN, or Individual Tax Identification Number, is for folks who need to deal with U.S. taxes but can't get a Social Security number. It's a big help for non-residents, those new to the U.S., family members of U.S. folks, or those tied to non-resident VISA holders. This means even if you tread the non-traditional path, with your ITIN and Guild Mortgage by your side, a home can be more than just a dream.

Here’s the breakdown:

Represented as Legacy Mortgage and Investment Corporation in the State Of California.

Are you ready to take the next step towards your financial goals? Let us guide you through a simple process to discover the perfect loan solution tailored to your unique needs.